Finding the ideal financing solution for your home purchase can sometimes be a challenge. Traditional lenders may not always offer the flexibility essential for every situation. This is where private lending became available as a strong possibility.

Private lenders offer customized financing arrangements that can meet the specific needs of investors. Whether you're looking to purchase a property with a less-than-perfect credit score, need a faster closing process, or are seeking alternative loan conditions, private lenders can be a valuable tool.

ul

li Considering the benefits and potential challenges of private lending is crucial before making a commitment.

li Conduct thorough research to locate reputable private lenders who align your objectives.

li Consult a experienced financial advisor to evaluate if private lending is the right approach for your needs.

Remember, choosing the right partner is a unique decision. By exploring different choices, you can unlock the possibility of private lending to achieve your homeownership aspirations.

Secure Your Dream Home with a Private Mortgage Loan

Purchasing your dream home is a major life achievement. But navigating the conventional mortgage process can be challenging, especially if you face specific financial conditions. That's where a non-QM mortgage loan comes in. These loans are designed to meet the needs of individuals who might not qualify for standard loans. A independent lender provides these loans, allowing you to purchase your dream home even if you have a diverse credit history or specific income pattern.

- Leverage the flexibility of a private mortgage loan to make your homeownership dreams a reality.achieve your homeownership aspirations.reach your housing goals.

- Connect with an experienced private lender to understand your financing options..

- Don't let a challenging credit history prevent you from owning your dream home.

Custom Funding: Personalized Mortgages Just for You

Are you searching for a custom home loan solution? Mainstream lenders often miss the mark when it comes to accommodating your individual financial circumstances. That's where alternative home loans step up.

- Customized loan terms to align with your financial picture

- Flexible repayment options

- Competitive interest terms

With a private home loan, you can obtain the capital you desire to achieve your homeownership goals. Reach out a experienced lender today to understand the opportunities of personalized financing.

Navigate Refinance with Confidence: Private Mortgage Options Explained uncover

Refinancing your mortgage can be a complex process, and understanding the range of options available is crucial. While conventional mortgages are frequent, private mortgage lenders offer alternative paths for homeowners seeking tailored financing solutions.

Private mortgages often appeal borrowers who may not meet the criteria for traditional loans due to factors such as credit history. These lenders prioritize a more hands-on approach, often evaluating assets beyond just credit scores.

- Private mortgages can offer greater flexibility in loan terms, such as longer repayment periods and fixed interest rates.

- Consequently, they can be a beneficial option for borrowers with unconventional financial situations.

However, it's essential to explore private lenders thoroughly before entering into a mortgage agreement. Scrutinize the interest rates, fees, and agreements carefully to ensure they match your financial goals.

Non-Conforming Loans: A Gateway to Customized Homeownership

For prospective homeowners seeking tailored financing solutions, private mortgages emerge as a attractive option. Unlike conventional mortgages offered by banks and lenders, private mortgages are arranged directly between borrowers and private individuals. This arrangement provides a level of adaptability that often eludes those navigating the traditional mortgage market.

Private mortgages frequently cater to individuals with non-standard financial histories. Whether dealing with credit challenges, unique property types, or volatile income streams, private lenders can extend options that may not be forthcoming through conventional channels.

However, it's crucial to remember that private mortgages often include higher interest rates and stricter terms compared to traditional loans. Meticulous due diligence, including a in-depth understanding of the contract, is paramount before venturing into a private mortgage deal.

Skip the Banks: Explore Private Lender Refinancing Opportunities

Are your client looking to secure a more favorable mortgage term? Established banks frequently possess limited lending criteria. This can result in difficulties for individuals requiring financing who are unable to qualify for typical loans. Despite this, private lenders provide a alternative solution. Private lenders often have less stringent lending procedures, making them a useful resource for individuals seeking financing in diverse situations.

- Consider private lenders if you are self-employed

- Alternative financing sources can be more accommodating to investors

- Explore private lender options thoroughly

Via investigating private lender refinancing, you can access a favorable mortgage.

check here Emilio Estevez Then & Now!

Emilio Estevez Then & Now! Ben Savage Then & Now!

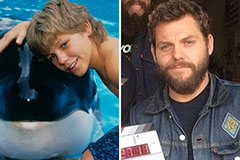

Ben Savage Then & Now! Jason J. Richter Then & Now!

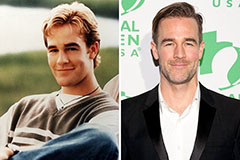

Jason J. Richter Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Burke Ramsey Then & Now!

Burke Ramsey Then & Now!